The STABLE Airdrop

Airdrop claims will open on Monday, December 8, 2025 at 12:00 UTC and close on Monday, March 2, 2026 at 12:00 UTC. Please note that all airdrop details are subject to change and will be updated through official Stable channels.

Stable Public Testnet Is Live

Bringing on-chain payments to global finance.

Introducing The STABLE Token: The Coordination Layer of the Stable Ecosystem

The STABLE Airdrop

Airdrop claims will open on Monday, December 8, 2025 at 12:00 UTC and close on Monday, March 2, 2026 at 12:00 UTC. Please note that all airdrop details are subject to change and will be updated through official Stable channels.

Stable Public Testnet Is Live

Bringing on-chain payments to global finance.

Introducing The STABLE Token: The Coordination Layer of the Stable Ecosystem

Share Dialog

Share Dialog

Over $780 million secured in on-chain assets on StableChain.

Over 3,000 smart contracts were deployed on StableChain in its first days.

StablePay will open for priority access soon, followed by a global launch.

With 150+ partners building the Stable ecosystem across traditional finance and fintech, Stable is delivering a vast ecosystem from the start.

More exciting updates for StableChain and StablePay are coming soon, with a focus on improved efficiency and user experience.

2025 marks the beginning of Stable and StableChain. Within a few months, we methodically turned an ambitious concept into testnet experimentation, and ultimately into a production mainnet - StableChain.

The core thesis remained consistent throughout this journey: the global economy needs stablecoin-native infrastructure designed for real-world transfers and payments. Existing blockchain rails, while revolutionary, were built to support blockchain adoption but left users wanting a better digital payments experience. Stable set out to change that.

In a few years, stablecoins have grown into a multi-billion-dollar asset class spanning trading, settlement, payment, and new sectors. Stablecoins now serve as the de facto bridge between traditional finance and the digital economy, effectively becoming the digital dollar.

Traditional blockchain networks face inherent limitations in supporting stablecoin use cases. Volatile gas fees, unpredictable transaction ordering, and a general-purpose execution environment create friction for businesses and retail users attempting to move value reliably.

Stable addresses these challenges through a focused approach built on these principles:

Predictability forms the foundation of StableChain. Business transactions need predictability in costs, settlement times, and user experiences. StableChain’s architecture delivers deterministic execution and consistent performance, providing certainty where it is needed most.

Stablecoin-native settlement recognizes that on-chain payments, in their current state, are best denominated in stablecoins. By building a blockchain from the ground up around stablecoins, Stable eliminates conversion steps, reduces friction, and aligns the entire stack with how businesses and consumers actually transact.

Real-world financial flows guided Stable’s every decision. Instead of trading and experimental DeFi activities, Stable focuses on the specific requirements of merchants, payment processors, remittance services, and institutional treasury operations.

With over $180 billion in circulation and 350 million users worldwide, USDT is the most widely adopted stablecoin, surpassing even Visa in transaction volume. It is around this largest stablecoin that we built our Stable vision, and upon this vision, we built StableChain.

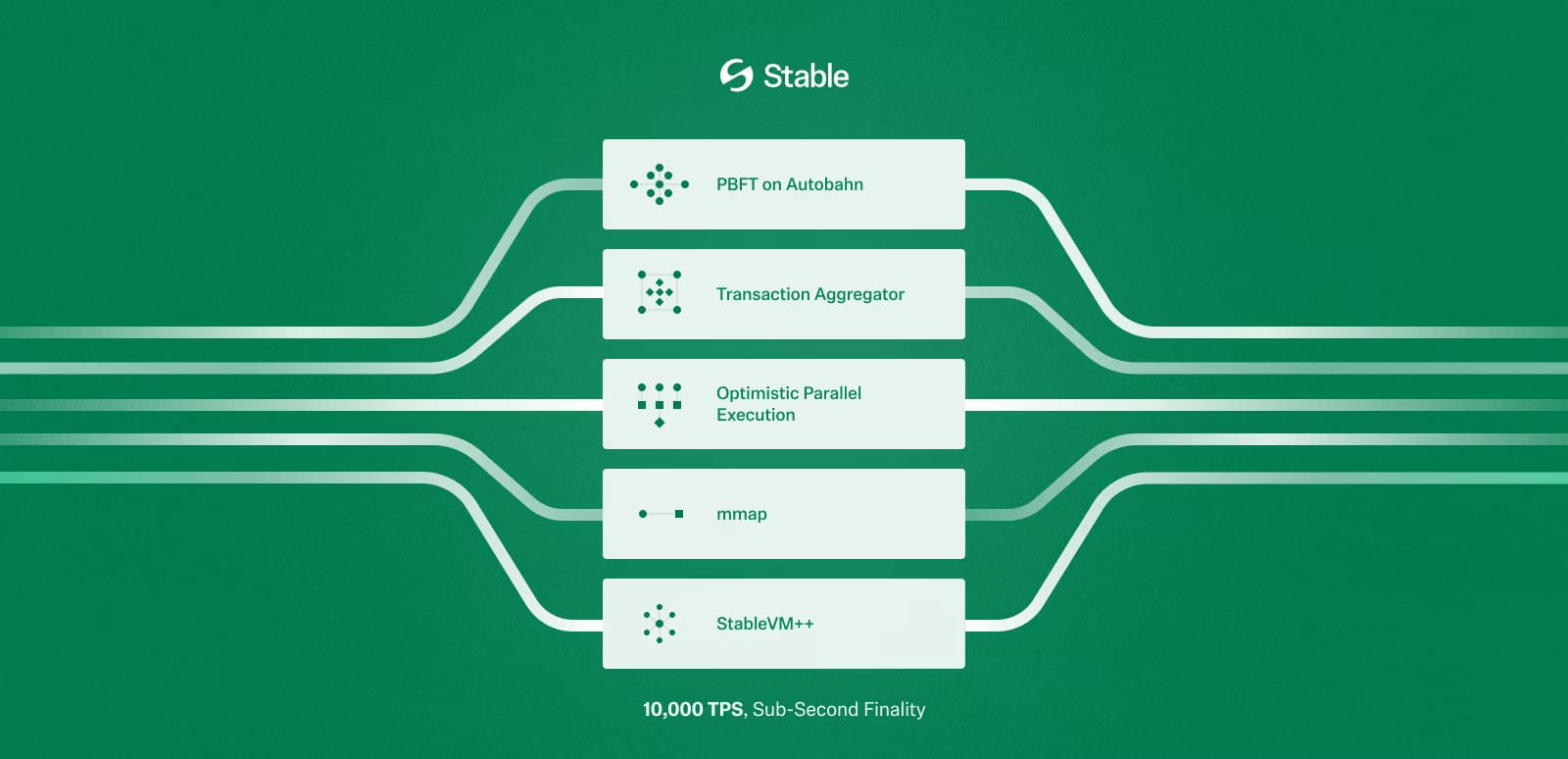

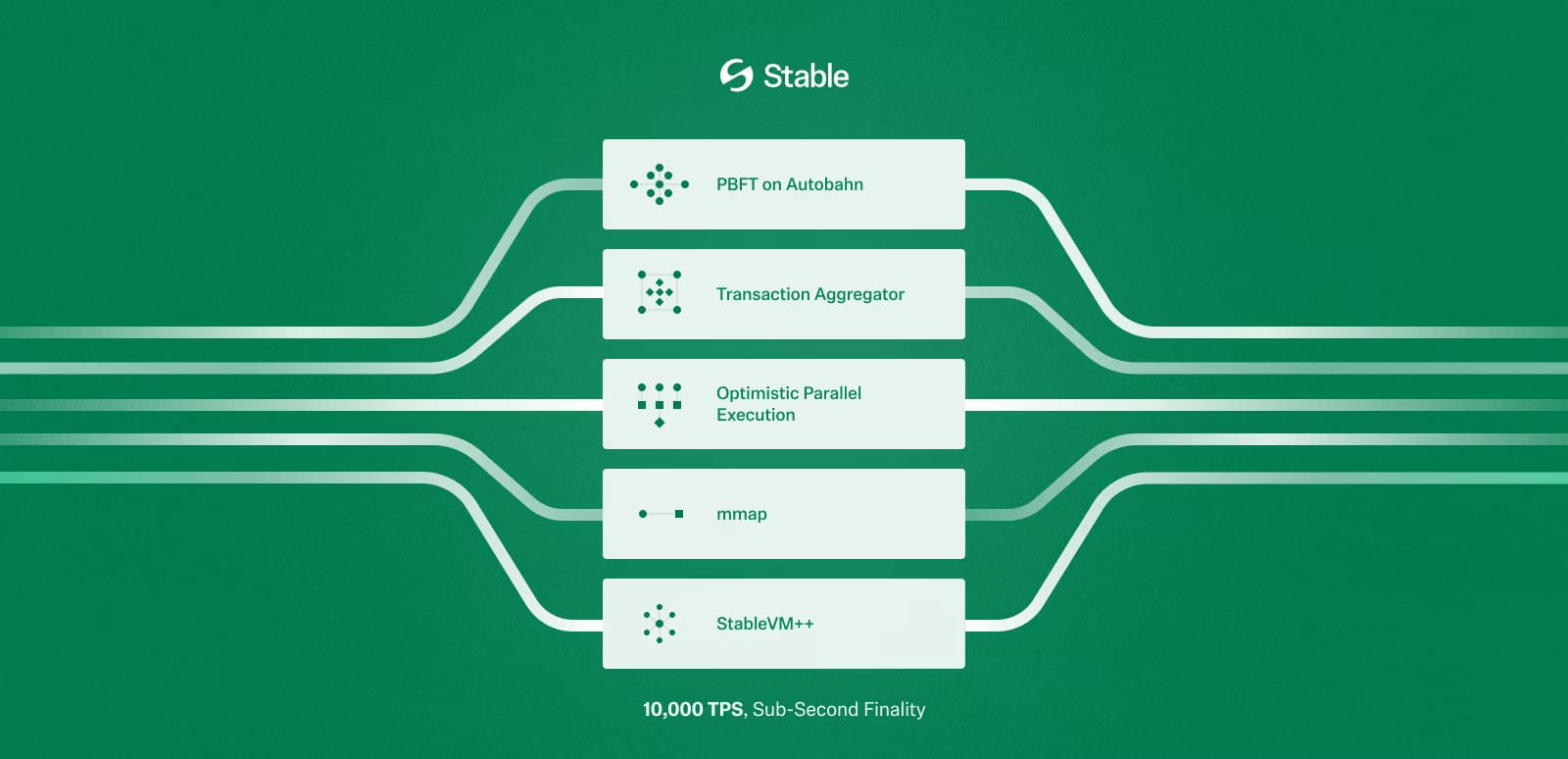

StableChain is the result of detailed planning and dedication; the team spent the better part of our time laying the technical foundation for the Stable ecosystem. After a comprehensive rethinking of blockchain infrastructure for payment applications, we designed an architecture that addresses performance bottlenecks across all layers of the stack, from state database management to execution and consensus.

Powering the StableChain is StableBFT, our implementation of the Byzantine Fault Tolerance consensus mechanism, which ensures high throughput, low latency, and strong reliability across the network. In the future, we also plan to further increase StableChain’s throughput by several fold through a redesign of our consensus architecture - Autobahn.

Stable also introduces a split-path remote procedure call (RPC) architecture that enables lightweight RPC nodes and an optimized data path. Together, they ensure transactions settle with sub-second block times and single-slot finality.

Built on top of these ultra-fast layers is StableEVM, an execution layer that provides full Ethereum compatibility and allows developers to migrate existing tools and smart contracts with minimal friction.

A Layer-1 blockchain optimized for USDT, StableChain has chosen gUSDT as its native gas token. As an unwrapped version of USDT0, gUSDT can be easily converted, and in most cases, smart contracts can make the conversion for its users. This means holding just USDT0 will allow you to access any asset on StableChain, mirroring a simple, traditional payment system where users can transact in a single currency.

By fusing these layers, Stable envisions a blockchain designed and optimized for payments and transactions with sub-second finality, capable of handling over 10,000 transactions per second (TPS).

At the beginning of November, StableChain testnet was open to the public. Within a few weeks, more than 500,000 accounts were created, and 177 smart contracts were verified. The StableChain testnet maintained an average block time of 0.73 seconds. Developers flocked to test their products, and the testnet handled the load steadily and reliably.

Powered by this confidence, the mainnet was live 5 weeks after our testnet launch. Within 2 weeks, StableChain gained exceptional on-chain traction, with over 3,000 smart contracts deployed, more than 25,000 active addresses, and over 380,000 transactions processed.

As the flagship application on StableChain, StablePay is a stablecoin payment wallet built by Stable. It offers everything Stable envisioned for the average consumer: instant transactions, predictable fees, and a seamless user experience. Every element was designed under our payment-first principle to deliver the payment experience you truly deserve, wherever you are and whoever you are.

StablePay is now in its final development phase, and the waitlist is open for signups. Join our waitlist now and get priority access at launch, early access to new features, and exclusive product updates.

Before our testnet and mainnet launch, we took a trip to this year’s Korean Blockchain Week (KBW2025). Greeted by an enthusiastic crypto community, we announced StablePay and our strategic partnership with PayPal. Our CEO, Brian, was featured in a session with Bo Hines, CEO of USAT and Strategic Advisor for Digital Assets.

Stable’s presence at KBW drew attention from outlets worldwide and once again demonstrated that its vision was recognized by builders, investors, and ecosystem participants.

Launched alongside StableChain was the $STABLE token, the governance token of StableChain and its ecosystem. $STABLE can be used to elect validators, vote on proposals, and receive gas fee emissions.

With a total supply of 100,000,000,000, $STABLE distributed 10% of all tokens at genesis via an airdrop, with the remainder unlocking over the next 4 years. This tokenomics was designed to empower builders, early supporters, and contributors who committed to Stable’s vision, prioritizing genuine ecosystem participation over speculation. Through $STABLE, validators, developers, users, and partners will all benefit from Stable’s growth, fostering a community invested in Stable’s long-term prosperity.

Stable pursued strategic partnerships in parallel with mainnet development, resulting in StableChain launching with a complete, production-ready ecosystem from day one. At launch, key partners across payments, custody, liquidity, and enterprise infrastructure were already live, enabling real-world stablecoin settlement from the first block. A few of our notable partners included:

PayPal Ventures & PayPal brought mainstream financial credibility and expanded the range of stablecoins on StableChain, signaling recognition from established payment companies of Stable’s vision and approach to blockchain payments. Together, PayPal and Stable are laying the foundations for digital dollars to become a true pillar of global finance. Learn more: PayPal Invests in Stable

Oobit brought global payments application expertise and reach to 30+ markets. With Stable, Oobit will expand the utility of USDT by connecting StableChain to real-world payment flows across more than 80 million Visa-supported merchants. Learn more: Oobit Partners with Stable

Orbital focuses on enterprise stablecoin payment infrastructure, addressing the specific requirements of businesses managing large-scale treasury operations and cross-border settlements. Stable will empower Orbital with its robust infrastructure and provide more efficient routing, reduced operational friction, predictable settlement costs, and optimized payment flows. Learn more: Orbital × Stable Partnership

Anchorage Digital is the leading digital asset platform bringing institutional custody, security, and regulatory compliance expertise to the Stable ecosystem. From day one, Anchorage will provide secure custody and infrastructure support for both the STABLE token and USDT0, forming a trusted foundation as we scale global stablecoin payments.

Theo, ULTRA, and Particula created a tokenized treasury investment ecosystem, demonstrating Stable’s ability to handle sophisticated financial products beyond simple asset transfers. With over $100 million contributed from both sides to ULTRA, the only AAA-rated tokenized U.S. Treasury strategy, this collaboration will grant institutions exposure to tokenized real-world assets on Stable’s infrastructure. Learn more: Stable and Theo Commit Over $100M to ULTRA

In November, our ecosystem partners, including Concrete, Hourglass, Frax, Morpho, and Pendle, co-launched the pre-deposit campaign, securing a total deposit cap of $1.325 billion. This partnership highlights the DeFi ecosystem's commitment to Stable, demonstrating that specialized payment infrastructure can be both anticipated and trusted.

Together, these partnerships ensure that StableChain is not only technically capable but also operationally ready to support builders, enterprises, and institutions with the tooling and reliability required for real-world stablecoin settlement.

Learn more about the Stable ecosystem at StableHub.

The foundation we established in 2025 sets the stage for expansion in functionality, performance, and adoption. Several key initiatives will define Stable’s path forward throughout 2026.

Making this the first item on our to-do list, StableChain will transition from gUSDT to USDT0 as its native gas asset, further simplifying settlement and improving efficiency & experience across wallets and applications. This change eliminates an additional abstraction layer and creates a more intuitive, frictionless user flow for your average consumers.

This will provide institutions with blockspace guarantees, ensuring predictability for high-volume transaction flows. This capability addresses one of the most significant pain points businesses face when considering blockchain adoption, offering the reliability enterprises need for financial operations.

In 2026, StablePay will enter public testing and be released in full. As a simple, consumer-friendly wallet explicitly designed for stablecoin-native retail transactions, StablePay will enable users and merchants to pay and receive stablecoins as easily as on traditional payment apps.

With this upgrade, peer-to-peer payments will be even easier and cheaper. Gas fees will be handled at the wallet level, and sybil-resistant mechanisms will keep payments secure and abuse-resistant, another major upgrade in user experience for retail users.

As a Layer-1 blockchain with institutional-level throughput, StableChain will scale through ongoing collaborations with enterprises, payment service providers, remittance operators, and fintech applications. These partnerships will bring more real-world use cases to Stable, driving real-world settlement volume through 2026 and translating technical capabilities into on-chain economic activity.

As USDT surpassed $180 billion in circulation volume and led the stablecoin race by a considerable margin, Stable’s settlement rail, purpose-built for USDT, will fuel the growth of the world’s most adopted stablecoin, capturing value as USDT penetrates new markets and use cases.

In 2025, Stable built the rails for stablecoin transactions & payments, turning a concept into a robust blockchain infrastructure - StableChain. On top of this blockchain, a bustling ecosystem emerged, with partnerships, tokenomics, and governance frameworks in place to support real-world stablecoin payment flows at scale.

In 2026, Stable will focus on improving the existing infrastructure and solidifying our role in the stablecoin economy. More use cases will be available on StableChain, putting it to the test by adding more daily transaction volume. As a result, Stable’s role will become increasingly valuable.

With a proven foundation, an engaged ecosystem, and cutting-edge technology, we focus on utility, transforming our vision from possibility into everyday reality.

Stable Pay: http://app.stable.xyz

Website: https://stable.xyz

X (formerly Twitter): https://x.com/stable

Discord: https://discord.gg/stablexyz

Telegram: https://t.me/stableannouncements

Partnership Form: https://forms.gle/LLPfKJbRiuqc7zeE8

Over $780 million secured in on-chain assets on StableChain.

Over 3,000 smart contracts were deployed on StableChain in its first days.

StablePay will open for priority access soon, followed by a global launch.

With 150+ partners building the Stable ecosystem across traditional finance and fintech, Stable is delivering a vast ecosystem from the start.

More exciting updates for StableChain and StablePay are coming soon, with a focus on improved efficiency and user experience.

2025 marks the beginning of Stable and StableChain. Within a few months, we methodically turned an ambitious concept into testnet experimentation, and ultimately into a production mainnet - StableChain.

The core thesis remained consistent throughout this journey: the global economy needs stablecoin-native infrastructure designed for real-world transfers and payments. Existing blockchain rails, while revolutionary, were built to support blockchain adoption but left users wanting a better digital payments experience. Stable set out to change that.

In a few years, stablecoins have grown into a multi-billion-dollar asset class spanning trading, settlement, payment, and new sectors. Stablecoins now serve as the de facto bridge between traditional finance and the digital economy, effectively becoming the digital dollar.

Traditional blockchain networks face inherent limitations in supporting stablecoin use cases. Volatile gas fees, unpredictable transaction ordering, and a general-purpose execution environment create friction for businesses and retail users attempting to move value reliably.

Stable addresses these challenges through a focused approach built on these principles:

Predictability forms the foundation of StableChain. Business transactions need predictability in costs, settlement times, and user experiences. StableChain’s architecture delivers deterministic execution and consistent performance, providing certainty where it is needed most.

Stablecoin-native settlement recognizes that on-chain payments, in their current state, are best denominated in stablecoins. By building a blockchain from the ground up around stablecoins, Stable eliminates conversion steps, reduces friction, and aligns the entire stack with how businesses and consumers actually transact.

Real-world financial flows guided Stable’s every decision. Instead of trading and experimental DeFi activities, Stable focuses on the specific requirements of merchants, payment processors, remittance services, and institutional treasury operations.

With over $180 billion in circulation and 350 million users worldwide, USDT is the most widely adopted stablecoin, surpassing even Visa in transaction volume. It is around this largest stablecoin that we built our Stable vision, and upon this vision, we built StableChain.

StableChain is the result of detailed planning and dedication; the team spent the better part of our time laying the technical foundation for the Stable ecosystem. After a comprehensive rethinking of blockchain infrastructure for payment applications, we designed an architecture that addresses performance bottlenecks across all layers of the stack, from state database management to execution and consensus.

Powering the StableChain is StableBFT, our implementation of the Byzantine Fault Tolerance consensus mechanism, which ensures high throughput, low latency, and strong reliability across the network. In the future, we also plan to further increase StableChain’s throughput by several fold through a redesign of our consensus architecture - Autobahn.

Stable also introduces a split-path remote procedure call (RPC) architecture that enables lightweight RPC nodes and an optimized data path. Together, they ensure transactions settle with sub-second block times and single-slot finality.

Built on top of these ultra-fast layers is StableEVM, an execution layer that provides full Ethereum compatibility and allows developers to migrate existing tools and smart contracts with minimal friction.

A Layer-1 blockchain optimized for USDT, StableChain has chosen gUSDT as its native gas token. As an unwrapped version of USDT0, gUSDT can be easily converted, and in most cases, smart contracts can make the conversion for its users. This means holding just USDT0 will allow you to access any asset on StableChain, mirroring a simple, traditional payment system where users can transact in a single currency.

By fusing these layers, Stable envisions a blockchain designed and optimized for payments and transactions with sub-second finality, capable of handling over 10,000 transactions per second (TPS).

At the beginning of November, StableChain testnet was open to the public. Within a few weeks, more than 500,000 accounts were created, and 177 smart contracts were verified. The StableChain testnet maintained an average block time of 0.73 seconds. Developers flocked to test their products, and the testnet handled the load steadily and reliably.

Powered by this confidence, the mainnet was live 5 weeks after our testnet launch. Within 2 weeks, StableChain gained exceptional on-chain traction, with over 3,000 smart contracts deployed, more than 25,000 active addresses, and over 380,000 transactions processed.

As the flagship application on StableChain, StablePay is a stablecoin payment wallet built by Stable. It offers everything Stable envisioned for the average consumer: instant transactions, predictable fees, and a seamless user experience. Every element was designed under our payment-first principle to deliver the payment experience you truly deserve, wherever you are and whoever you are.

StablePay is now in its final development phase, and the waitlist is open for signups. Join our waitlist now and get priority access at launch, early access to new features, and exclusive product updates.

Before our testnet and mainnet launch, we took a trip to this year’s Korean Blockchain Week (KBW2025). Greeted by an enthusiastic crypto community, we announced StablePay and our strategic partnership with PayPal. Our CEO, Brian, was featured in a session with Bo Hines, CEO of USAT and Strategic Advisor for Digital Assets.

Stable’s presence at KBW drew attention from outlets worldwide and once again demonstrated that its vision was recognized by builders, investors, and ecosystem participants.

Launched alongside StableChain was the $STABLE token, the governance token of StableChain and its ecosystem. $STABLE can be used to elect validators, vote on proposals, and receive gas fee emissions.

With a total supply of 100,000,000,000, $STABLE distributed 10% of all tokens at genesis via an airdrop, with the remainder unlocking over the next 4 years. This tokenomics was designed to empower builders, early supporters, and contributors who committed to Stable’s vision, prioritizing genuine ecosystem participation over speculation. Through $STABLE, validators, developers, users, and partners will all benefit from Stable’s growth, fostering a community invested in Stable’s long-term prosperity.

Stable pursued strategic partnerships in parallel with mainnet development, resulting in StableChain launching with a complete, production-ready ecosystem from day one. At launch, key partners across payments, custody, liquidity, and enterprise infrastructure were already live, enabling real-world stablecoin settlement from the first block. A few of our notable partners included:

PayPal Ventures & PayPal brought mainstream financial credibility and expanded the range of stablecoins on StableChain, signaling recognition from established payment companies of Stable’s vision and approach to blockchain payments. Together, PayPal and Stable are laying the foundations for digital dollars to become a true pillar of global finance. Learn more: PayPal Invests in Stable

Oobit brought global payments application expertise and reach to 30+ markets. With Stable, Oobit will expand the utility of USDT by connecting StableChain to real-world payment flows across more than 80 million Visa-supported merchants. Learn more: Oobit Partners with Stable

Orbital focuses on enterprise stablecoin payment infrastructure, addressing the specific requirements of businesses managing large-scale treasury operations and cross-border settlements. Stable will empower Orbital with its robust infrastructure and provide more efficient routing, reduced operational friction, predictable settlement costs, and optimized payment flows. Learn more: Orbital × Stable Partnership

Anchorage Digital is the leading digital asset platform bringing institutional custody, security, and regulatory compliance expertise to the Stable ecosystem. From day one, Anchorage will provide secure custody and infrastructure support for both the STABLE token and USDT0, forming a trusted foundation as we scale global stablecoin payments.

Theo, ULTRA, and Particula created a tokenized treasury investment ecosystem, demonstrating Stable’s ability to handle sophisticated financial products beyond simple asset transfers. With over $100 million contributed from both sides to ULTRA, the only AAA-rated tokenized U.S. Treasury strategy, this collaboration will grant institutions exposure to tokenized real-world assets on Stable’s infrastructure. Learn more: Stable and Theo Commit Over $100M to ULTRA

In November, our ecosystem partners, including Concrete, Hourglass, Frax, Morpho, and Pendle, co-launched the pre-deposit campaign, securing a total deposit cap of $1.325 billion. This partnership highlights the DeFi ecosystem's commitment to Stable, demonstrating that specialized payment infrastructure can be both anticipated and trusted.

Together, these partnerships ensure that StableChain is not only technically capable but also operationally ready to support builders, enterprises, and institutions with the tooling and reliability required for real-world stablecoin settlement.

Learn more about the Stable ecosystem at StableHub.

The foundation we established in 2025 sets the stage for expansion in functionality, performance, and adoption. Several key initiatives will define Stable’s path forward throughout 2026.

Making this the first item on our to-do list, StableChain will transition from gUSDT to USDT0 as its native gas asset, further simplifying settlement and improving efficiency & experience across wallets and applications. This change eliminates an additional abstraction layer and creates a more intuitive, frictionless user flow for your average consumers.

This will provide institutions with blockspace guarantees, ensuring predictability for high-volume transaction flows. This capability addresses one of the most significant pain points businesses face when considering blockchain adoption, offering the reliability enterprises need for financial operations.

In 2026, StablePay will enter public testing and be released in full. As a simple, consumer-friendly wallet explicitly designed for stablecoin-native retail transactions, StablePay will enable users and merchants to pay and receive stablecoins as easily as on traditional payment apps.

With this upgrade, peer-to-peer payments will be even easier and cheaper. Gas fees will be handled at the wallet level, and sybil-resistant mechanisms will keep payments secure and abuse-resistant, another major upgrade in user experience for retail users.

As a Layer-1 blockchain with institutional-level throughput, StableChain will scale through ongoing collaborations with enterprises, payment service providers, remittance operators, and fintech applications. These partnerships will bring more real-world use cases to Stable, driving real-world settlement volume through 2026 and translating technical capabilities into on-chain economic activity.

As USDT surpassed $180 billion in circulation volume and led the stablecoin race by a considerable margin, Stable’s settlement rail, purpose-built for USDT, will fuel the growth of the world’s most adopted stablecoin, capturing value as USDT penetrates new markets and use cases.

In 2025, Stable built the rails for stablecoin transactions & payments, turning a concept into a robust blockchain infrastructure - StableChain. On top of this blockchain, a bustling ecosystem emerged, with partnerships, tokenomics, and governance frameworks in place to support real-world stablecoin payment flows at scale.

In 2026, Stable will focus on improving the existing infrastructure and solidifying our role in the stablecoin economy. More use cases will be available on StableChain, putting it to the test by adding more daily transaction volume. As a result, Stable’s role will become increasingly valuable.

With a proven foundation, an engaged ecosystem, and cutting-edge technology, we focus on utility, transforming our vision from possibility into everyday reality.

Stable Pay: http://app.stable.xyz

Website: https://stable.xyz

X (formerly Twitter): https://x.com/stable

Discord: https://discord.gg/stablexyz

Telegram: https://t.me/stableannouncements

Partnership Form: https://forms.gle/LLPfKJbRiuqc7zeE8

No comments yet